|

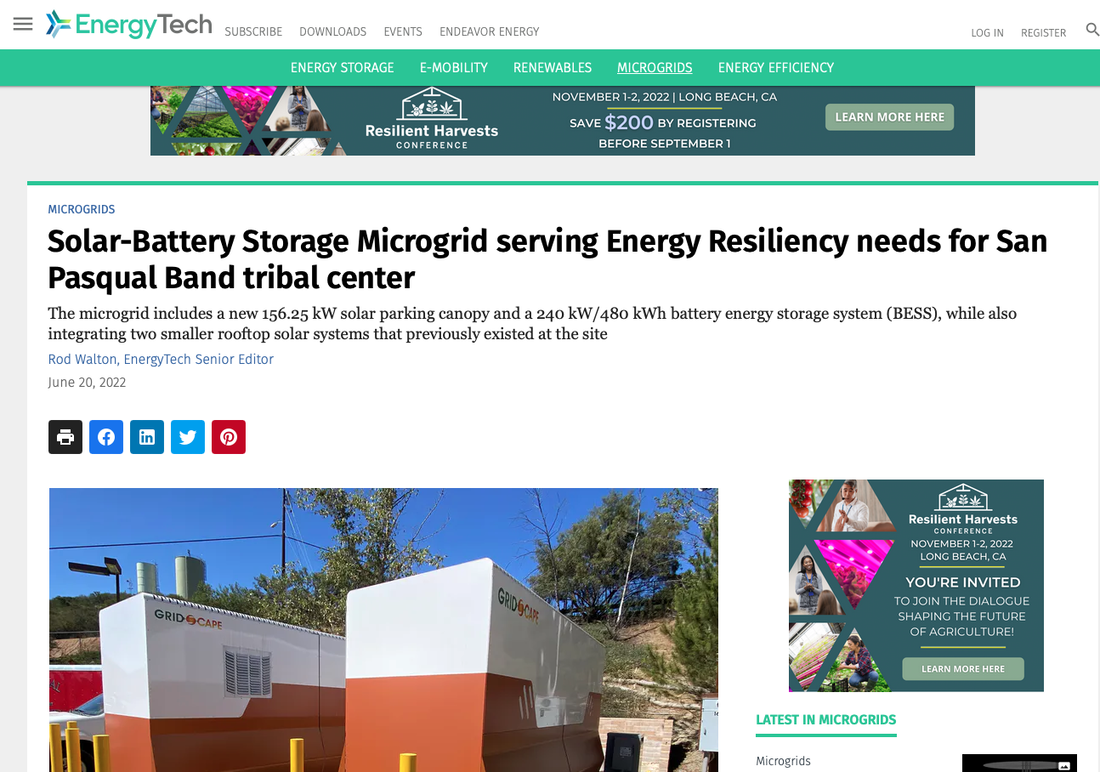

Check out the whole story at: https://www.energytech.com/microgrids/article/21244677/solarbattery-storage-microgrid-serving-energy-resiliency-needs-for-san-pasqual-band-government-center

0 Comments

Science Friday: Growing Plants--And Providing Solar EnergyFollow the above link to listen to Science Friday's report on agrivoltaics.

Food is one of our most basic needs. As the population of the world grows, we’re going to need to grow more of it within the same amount of space. The United Nations estimates the world’s population will grow by 2 billion people between now and 2050. Access to fresh food is already a problem in many countries, and will likely get worse with more mouths to feed. This is where the concept of agrivoltaics could create a massive change. This farming setup mixes water, energy, and plant growth all in one space. Solar panels collect energy from the sun’s rays; underneath those panels is where the plants grow. The setup takes less water than the traditional way of farming, all-in-all creating a more sustainable way to grow food and create energy. Joining Ira to talk about the promise of agrivoltaics is Dr. Chad Higgins, associate professor of biological and ecological engineering at Oregon State University, in Corvallis, Oregon. All California communities in utility PG&E’s service area eligible for microgrid programme1/13/2022 Renewable -plus-storage microgrids are in big demand these days. The "Community Microgrid Enablement Program (CMEP) operates under a special tariff approved by the CPUC.

https://www.energy-storage.news/all-california-communities-in-utility-pges-service-area-eligible-for-microgrid-programme/ By Andy Colthorpe December 3, 2021 Americas, US & Canada Connected Technologies, Off Grid Policy, Technology In April this year, PG&E, one of the state’s big three investor-owned utilities (IOUs), rolled out the Community Microgrid Enablement Program (CMEP). The programme operates under a special tariff approved by the regulatory California Public Utilities Commission (CPUC). It offers financial as well as technical guidance and design support for interconnected exporting energy producing resources that do not exceed 20MW in aggregate within a PG&E distribution grid connection point. PG&E said that the multi-customer microgrid projects will largely be modelled on and replicated from an initial pilot project, Redwood Coast Airport Renewable Energy Microgrid. That front-of-meter project includes a DC-coupled 2.2MW PV array coupled with a 2MW / 8MWh Tesla battery energy storage system (BESS). That microgrid will provide renewable energy to customers that include an airport and US Coast Guard Station, as well as providing a community in Humboldt County with backup power that can kick in in the event of an outage. It is able to operate as a grid-connected asset as well as capability to be ‘islanded’ and operate independently. Initially, the programme was available to communities in High Fire Threat Districts. These were areas most at-risk from wildfires and the Public Safety Power Shutoff (PSPS) events that PG&E has enacted to prevent its electrical infrastructure from potentially causing more wildfires — as has unfortunately been the case in the past. PG&E has about five and a half million customers and the utility requested permission from the CPUC to expand eligibility to all in its service area, which the regulator has approved. In addition to the community microgrid programme, PG&E got permission last year to supply customers in the worst-affected PSPS areas with 450MW of “temporary mobile generation” systems. https://www.renewableenergyworld.com/2019/09/19/a-billion-dollars-old-c-pace-spreads-its-wings/

By Philippe Hartley - 9.19.2019 Credit: Philippe HartleyThere were early days in solar when news of secured financing for a commercial project yielded an exuberant round of high-fives in the office, and maybe you’d quit early for a round of beers. In 2008, PPA’s opened-up possibilities, and multiple variances on leases showed promise in what was still a slower-paced market with higher installation margins. Today there’s a lot of work to do, and little time to do it. It’s a planetary thing. Financing needs to be on wheels. We know that a large part of the $10 trillion-worth of privately-owned commercial real estate in the US will require unprecedented financing for energy infrastructure upgrades, among other things. Banks will not provide 20 or 30-year credit, in most cases, for capital improvements. Credit-based lending is elusive for businesses that are leveraged. Anyone depending on solar PPA’s to sell PV plants knows the challenge of qualifying their customers for such financing, especially in small to medium projects. There are certainly senior-debt methods of getting large projects done for sizable companies with robust credit-ratings; but most of America’s enterprises are not that. C-PACE Today Fortunately, Commercial Property-Assessed Clean Financing (C-PACE) is growing, and its continued rapid rise in volume is virtually guaranteed nationally. This is because the funding mechanism creates hundreds of billions of dollars of critically needed, newly minted credit for property owners, and it does so in a way that is favorable to the balance sheet. In a past article, I had pegged a 2018 historic milestone of a billion dollars of funded projects. I was some months off, but at some point this year, that milestone will have been breached with momentum. To illustrate, consider that over the last 4 years the growth of C-PACE in new construction financing has grown by about 100% each year. This is great news for all, especially for manufacturers, contractors, engineers, financiers, building owners and developers. The new face of C-PACE is to your climate crisis future what Rosie the Riveter was to World War II: eager, resourceful, creative and high energy. It is a haven of entrepreneurship, and we are only just beginning to feel its impact. Funder and program competition are taking hold. Anyone wishing to leverage needs to upgrade their knowledge of this powerful mechanism. Programs and Funders Differ Today’s C-PACE is as diverse as any other product, the acronym itself being a generic term like “mortgage.” Behind it are many different name brands offering different products. None has a corner on the market because each funding product and PACE districts has features that may or may not be ideal for your customer or your project. Some of the ways they differ are obvious, many are not, or downright arcane. The chart included here looks at some of them. A single difference between two funders in one of those areas can allow your project to move forward or stumble. This is why it is important to approach the C-PACE funder choice with discrimination. In essence, as the capital market discovers the power of C-PACE as an instrument, the diversity of funds requires that one understand their difference, as well as their respective strengths and weaknesses. It’s a rapidly changing scape. Specialty funds and programs are getting set-up. Marketers are becoming more sophisticated at differentiating themselves, and money is beginning to specialize in market segments. The seemingly most popular commercial solar cashflow modeling tool in the industry, Energy Toolbase, feels the trend; their Chief Operating Officer Adam Gerza told me “Over the last year or two, we’ve definitely had more requests for financing integrations on our platform from C-PACE providers than for, say, PPA or Lease providers.” If you are an EPC or renewable energy installer, expanded options within the great new world of C-PACE mean greater ability to bring contracts to close; you can now address a wider range of scenarios and client circumstances, all within this evolving pocket of property-assessment credit. Mastering the scape and scope of PACE funders, or lining yourself up with an agency that does, will provide a competitive factor in your origination strategy. Telling Siri to call that same PACE funder each time you cross your fingers for financing assumes there is only one tool in the shed. Opportunistically, leveraging today’s C-PACE can expand your business as well. Here are examples of how developers are taking advantage of this expanding financing solution: Lowering customer acquisition cost through symbiotic trades One of the many advantages of PACE is its applicability to hundreds of different upgrades. Once a building has been approved for a renewable energy upgrade, there is often a nice amount of credit that remains available for other energy, water or abatement upgrades. It gives the contractor the opportunity to offer a financed solution for other improvements the building owner might have been considering, such as HVAC, double paned windows, or even a new face coat. Aron Hauser ran sales for solar companies for nine years before he decided to manage a new solar division for a Southern California roofing company now called Preman Roofing and Solar; his job was to expand their business into pv installations. “I can tap into 20 years of goodwill with our customers who understand the importance of solid roof penetrations. That’s a solid base from which to build a new business. Couple that with the fact that I can bring a single financing solution for both our energy generation and energy efficiency roofing sides, and now I have a winning proposition for the customer. It has opened doors for our carport business as well. We’ve become a packaged solution provider.” Opening new territories across states Developers and contractors with interstate ambitions can leverage the C-PACE financing mechanism by marketing themselves through national associations, businesses, or industries. While C-PACE is not yet national (each state develops its own program), there are funders in each of the active states. Generally speaking, C-PACE funders are motivated to associate themselves with at least one of the administrative districts in any state with an active program. Cumulatively, that gives you access to more project funding than has ever been available before. Source: PACEnationRalph Ciarlanti runs Green Realities Inc., an EPC that helps large hotel groups lower their operating costs by incorporating solar and storage into their infrastructure plans. “My work requires finding financing solutions for locations across the west and beyond” Ralph says, “ C-PACE is emerging as a very interesting long-term funding source because it addresses multiple geographies via a single method that allows my clients to keep all their tax benefits.” Ralph might not be able to, or choose to, fund all the projects of a chain through the same funder, given that each property’s location might impact his availability of funders. But the client will appreciate the common attributes of C-PACE for their balance sheet across all of their eligible projects. It’s a Commercial Financial Service C-PACE now enters a new phase; let’s call it 2.0. There are billions of dollars waiting for your infrastructure or green building project via C-PACE today. That adds up to a competitive business much like other commercial financial services, like insurance or mortgage. Unlike in the early days of solar financing, C-PACE shifts the financing odds a bit more in favor of the property owner, if one knows how to leverage that resource. It’s a new world for commercial project financing, and good news for the entire country. If you’re watching the sea levels rise, you might say it’s not a minute too soon. Author

|

Links

Check for Renewable Energy/Utility Rebates in your area

Pace Program http://pacenow.org/resources/all-programs/#California California First https://californiafirst.org/property_owners_overview Figtree http://www.figtreecompany.com/ U.S. Dept. of Energy Wind Maps Real Time Wind Speed Maps Renewable Energy News Alternative Energy News Green Energy News Home Power Magazine |